TermLife Solitaire

Get $500,000 coverage or more against terminal illness and death.

Here’s how TermLife Solitaire protects your financial legacy.

- Stay protected against death and terminal illness with a sum assured[1] of at least $500,000.

- Enjoy a complimentary one-time medical concierge service[2] when your application has a minimum sum assured of $3 million.

- Enjoy guaranteed renewal[3] of your policy, you may be covered up to age 100 (last birthday).

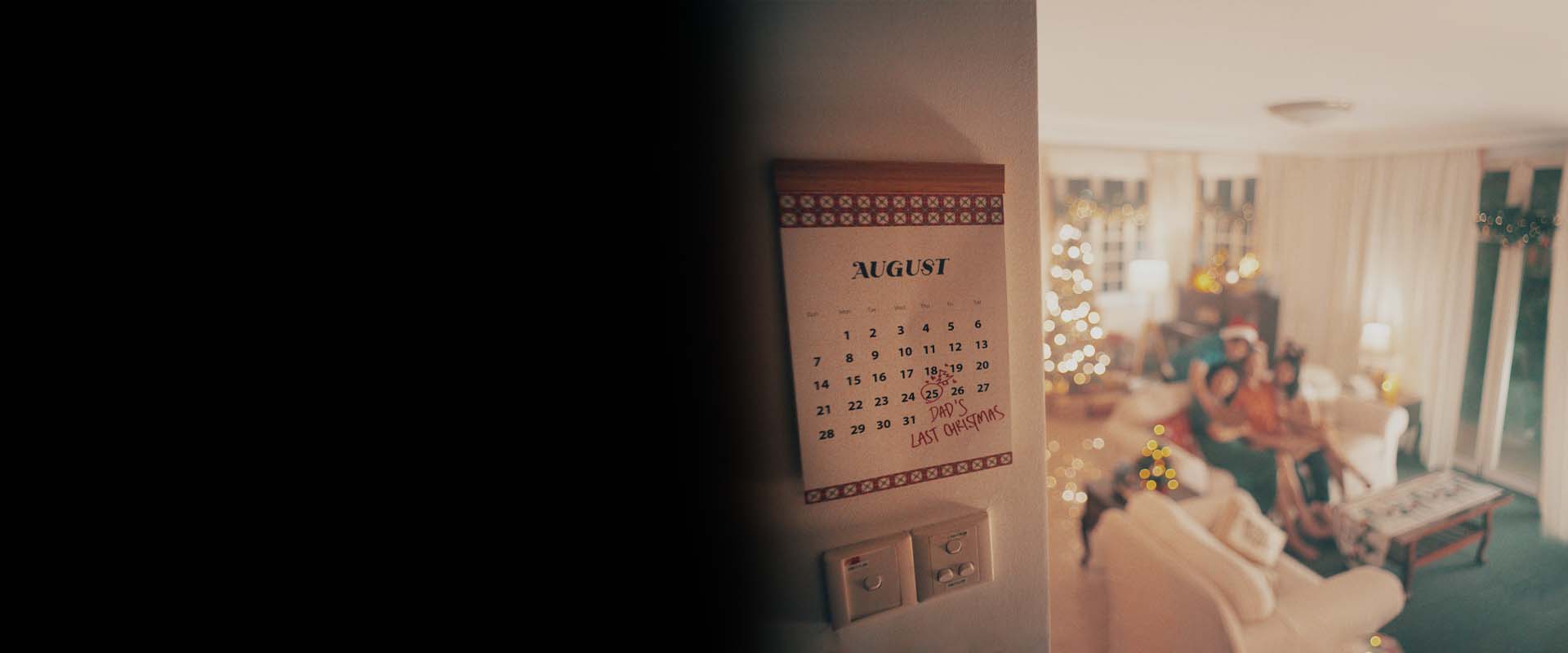

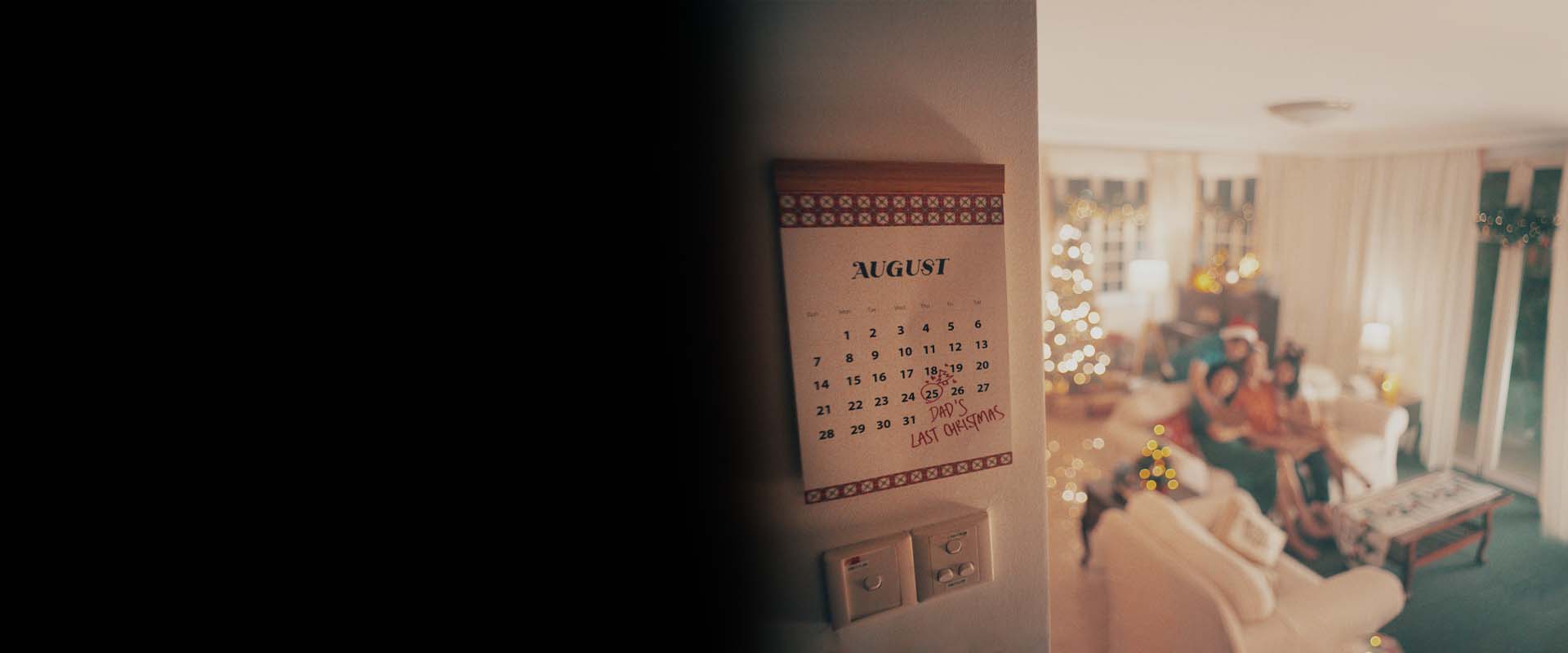

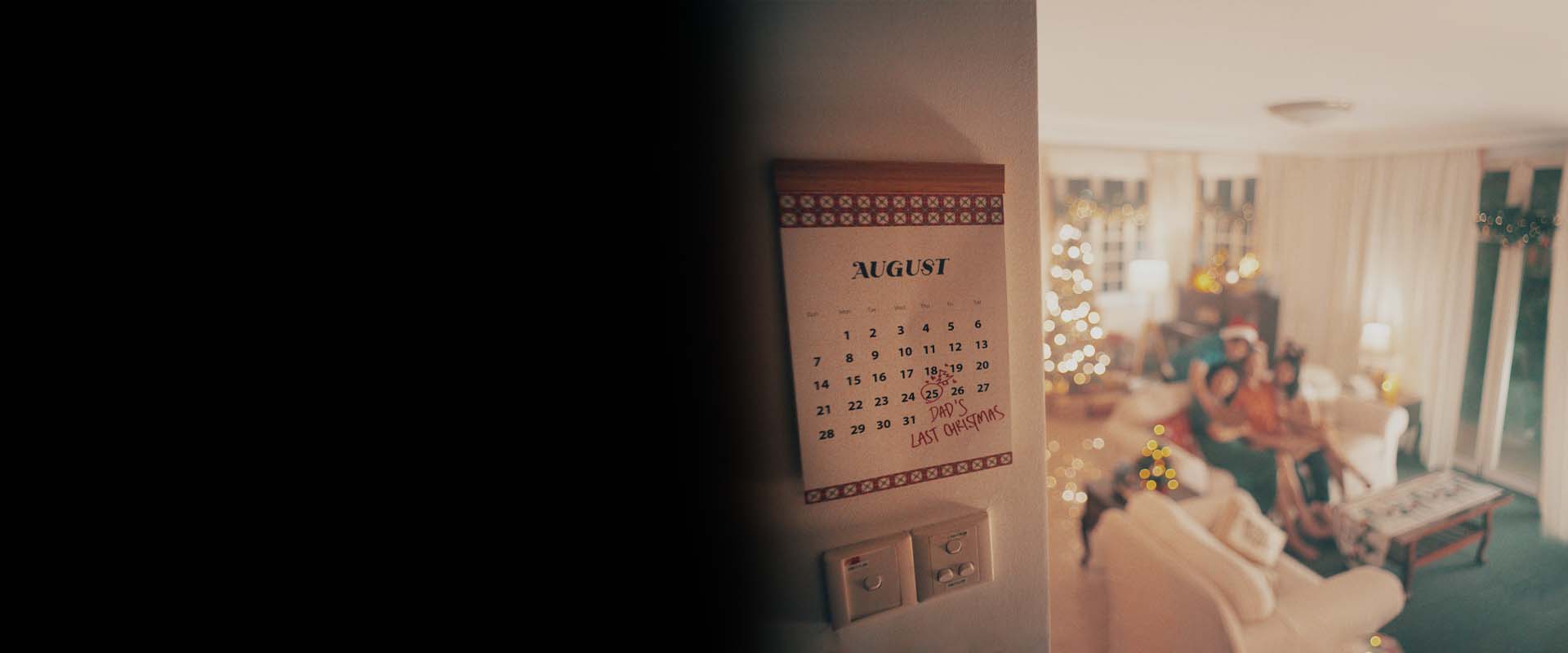

Dad's Last Christmas

Watch how you can let your final moments be a memory, not a pain.

Learn more about our benefits.

Disability Accelerator

You will receive the sum assured[4] under this rider upon diagnosis with total and permanent disability (TPD before the anniversary of the policy immediately after age 70) during the term of the rider.

Total Protect

You will receive the sum assured for this rider upon diagnosis of early, intermediate or advanced stage specified dread diseases[5][6] (except angioplasty and other invasive treatment for coronary artery) during the term of the rider.

The rider also provides Advanced Restoration Benefit[7], which offers extra coverage for stroke with permanent neurological deficit, major cancer, and heart attack of specified severity after an early or intermediate stage dread disease claim is made.

Essential Protect

You will receive the sum assured for this rider in the event of death, total and permanent disability (TPD before age 70), terminal illness or diagnosis of dread disease[5] (except for angioplasty and other invasive treatment for coronary artery) during the term of the rider.

Hospital CashAid

Enhance your coverage with Hospital CashAid rider[8] that provides payouts in the event of hospitalisation, to help reduce your out-of-pocket expenses. With the Major Impact Benefit[9], you will also be covered against future unknown diseases[9] or serious infections if you undergo a surgery or suffer from an infection and you need to stay in an Intensive Care Unit (ICU) for 5 days or more at a go.

Choose your rider term with coverage up to a maximum of age 84 (last birthday).

Payor Premium Waiver

(only applicable if the insured is not the policyholder)

You will not need to make future premium payments for the basic policy that you have bought for a loved one, if you pass away, or are totally and permanently disabled (TPD before age 70) during the term of the rider.

Enhanced Payor Premium Waiver

(only applicable if the insured is not the policyholder)

You will not need to make future premium payments for the basic policy that you have bought for a loved one, if you pass away, are totally and permanently disabled (TPD before age 70), are diagnosed with terminal illness or dread disease[5] during the term of the rider.

Dread Disease Premium Waiver

You will not need to make future premium payments for your basic policy if you are diagnosed with dread disease[5] (except for angioplasty and other invasive treatment for coronary artery) during the term of the rider.

Let us walk you through TermLife Solitaire.

How TermLife Solitaire preserves your legacy

40 years old

Mr and Mrs Tan, both age 40, non-smokers, sign up for TermLife Solitaire, insuring each other's lives with a sum assured of $1,000,000 each and a policy term till age 100. They add a Payor Premium Waiver rider 1 with a maximum term till age 84 and a Disability Accelerator rider 2 with a sum assured of $1,000,000. They also choose to pay premiums on a yearly mode.

Policy 1

Mr Tan purchases TermLife Solitaire on the life of Mrs Tan. Yearly premium = $4,510 (including premium for Payor Premium Waiver rider 1 and Disability Accelerator rider 2 )

Policy 2

Mrs Tan purchases TermLife Solitaire on the life of Mr Tan. Yearly premium = $5,705 (including premium for Payor Premium Waiver rider 1 and Disability Accelerator rider 2 )

60 years old

Should Mr Tan be diagnosed with total and permanent disability at the age of 60, Mrs Tan will receive the payout of $1,000,000 from Policy 2, which can be used to pay off any outstanding loans and help the family maintain their current lifestyle. Policy 2 terminates. Policy 1 insuring Mrs Tan will remain inforce with future premiums waived until Payor Premium Waiver rider 1 term expires.

100 years old

End of policy term for Policy 1.

The figures used are for illustrative purposes only and are rounded to the nearest dollar. 1 For Payor Premium Waiver, the premium waiver benefits are applicable only if the insured is not the policyholder. 2 Disability Accelerator rider pays the sum assured under this rider if the insured becomes totally and permanently disabled (before the anniversary immediately after the insured reaches the age of 70) during the term of the rider. This rider will end after Income Insurance makes this payment. Any payment under this rider will form an accelerated payment and reduce the sum assured of its basic policy and other accelerated riders by the same amount that Income Insurance pays under this rider.

How TermLife Solitaire safeguards your business

50 years old

Mr Ong, a non-smoker, is a director of ABC Company, and crucial to the success of the business. To ensure business continuity in case of the unexpected loss of Mr Ong, ABC Company signs up for TermLife Solitaire to insure him. Sum assured: $2,000,000.

The company also adds a Disability Accelerator rider 1 with a sum assured of $2,000,000 and chooses a policy and rider term of 15 years. Yearly premium = $3,863 (including premium for Disability Accelerator rider 1 )

- Death

- Terminal illness

- Total and permanent disability

65 years old

End of policy and rider term.

The figures used are for illustrative purposes only and are rounded to the nearest dollar.

1 Disability Accelerator rider pays the sum assured under this rider if the insured becomes totally and permanently disabled (before the anniversary immediately after the insured reaches the age of 70) during the term of the rider. This rider will end after Income Insurance makes this payment. Any payment under this rider will form an accelerated payment and reduce the sum assured of its basic policy and other accelerated riders by the same amount that Income Insurance pays under this rider.

Footnotes

- If the insured becomes terminally ill or dies during the term of the policy, Income Insurance will pay the sum assured. The policy will end when Income Insurance make this payment.

- The service is valid for one time usage per policy and is only for arrangement of a full medical check-up. No-show penalty is applicable when the insured failed to cancel the check-up and transport booking within the given notice period. The insured will need to check with the respective clinic for more details.

- Income Insurance will renew your policy for the same policy term at its prevailing sum assured only if your policy has not ended as a result of a claim during its term and the insured is age 74 (last birthday) and below. However, if the original policy term is not a multiple of five years, or if the original policy term is a multiple of five years but the anniversary immediately after the insured’s 100 th birthday falls within the next policy term, Income Insurance will renew it for a shorter term that is a multiple of five years, as long as the minimum term is 10 years, such that the renewal term will neither go beyond the original policy term, nor the anniversary immediately after the insured’s 100 th birthday. Income Insurance will work out the renewal premium based on the policy’s renewal term, sum assured and the age of the insured at the time the policy is renewed.

- Disability Accelerator rider pays the sum assured under this rider if the insured becomes totally and permanently disabled (before the anniversary immediately after the insured reaches the age of 70) during the term of the rider. This rider will end after Income Insurance make this payment. Any payment under this rider will form an accelerated payment and reduce the sum assured of its basic policy and other accelerated riders by the same amount that Income Insurance pays under this rider.

- Total Protect, Essential Protect, Enhanced Payor Premium Waiver and Dread Disease Premium Waiver.

You can find the list of specified dread diseases and their definitions in their respective policy contracts. Income Insurance will not pay this benefit if the insured is diagnosed with the disease within 90 days from the cover start date for major cancer, heart attack of specified severity, coronary artery by-pass surgery, angioplasty and other invasive treatment for coronary artery or other serious coronary artery disease.

If the insured undergoes angioplasty and other invasive treatment for coronary artery during the term of the rider, Income Insurance will pay 10% of the sum assured, up to S$25,000. Income Insurance will only pay for this condition once under this benefit. After this payment, Income Insurance will reduce the sum assured of this rider accordingly. Income Insurance will work out any future premiums or claims based on the reduced sum assured.

For Dread Disease Premium Waiver and Enhanced Payor Premium Waiver, the premium waiver benefits do not apply for angioplasty and other invasive treatment for coronary artery.

- Total Protect is a rider that provides coverage against early, intermediate and advanced stage specified dread disease. Income Insurance pays the sum assured under this rider upon diagnosis of the insured with one of the specified dread diseases (except angioplasty and other invasive treatment for coronary artery) during the term of the rider. Any payment for an early and intermediate stage specified dread diseases will reduce the sum assured of the rider to zero. You can find the list of early, intermediate and advanced stage specified dread diseases and their definitions in their respective policy contracts.

- If you are successful in claiming the early and intermediate stage dread disease benefit, all benefits under this rider will end except the Advanced Restoration Benefit. You will stop making premium payments on this rider. This rider will continue to apply for the Advanced Restoration Benefit during this period even though you are not paying the premiums.

Income Insurance will not pay this benefit if the insured suffered symptoms of, had investigations for, or was diagnosed with the disease at any time before or within 90 days from the cover start date for major cancer, heart attack of specified severity, other serious coronary artery disease, or coronary artery by-pass surgery.

Income Insurance will pay no more than $350,000 (not including bonuses) for each insured (no matter how many policies Income Insurance have issued to cover each insured).

Please refer to the policy contract for further details.

- For Hospital CashAid, the premium will be based on the prevailing premium rates as of the insured’s age and sum assured at the anniversary. Please refer to the policy contract for further details.

- An event (including a future unknown disease) leading to a surgery or an infection, and requires a stay in ICU for 5 days or more, which is claimable under the Major Impact Benefit, subject to policy’s terms, conditions and exclusions. The surgery or infection and the stay in the ICU must be directly due to the same cause and confirmed as necessary medical treatment. Income Insurance will not pay Major Impact Benefit where the insured stays in a hospital for symptoms suffered of, had investigations for, or was diagnosed with illness any time before or within 90 days from the cover start date (except for accidents). Income Insurance will pay this benefit in addition to both Hospital Cash Benefit and Additional Intensive Care Unit Benefit. Income Insurance will pay this benefit to you only once per policy year. Please refer to the policy contract for further details.

Important Notes

This is for general information only. You can find the usual terms, and conditions and exclusions of this plan in the policy conditions. All our products are developed to benefit our customers but not all may be suitable for your specific needs. If you are unsure if this plan is suitable for you, we strongly encourage you to speak to a qualified insurance advisor. Otherwise, you may end up buying a plan that does not meet your expectations or needs. As a result, you may not be able to afford the premiums or get the insurance protection you want. This plan does not have any cash value.

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact Income Insurance or visit the GIA/LIA or SDIC web-sites (gia.org.sg or lia.org.sg or sdic.org.sg.)

This advertisement has not been reviewed by the Monetary Authority of Singapore.

Information is correct as at 16 August 2024.